Because Their Future Deserves Security

A legacy of love begins with financial protection. Our life insurance solutions provide a reliable safety net for your family, ensuring they’re cared for—even when life takes an unexpected turn. Let us help you secure the future of those who matter most.

“Your family’s security—guaranteed, for a lifetime.”

Life Insurance with NiveshSetu: Protecting Your Family’s Tomorrow, Today

What is Life Insurance?

Life is unpredictable, but your family’s future doesn’t have to be. Life insurance is a commitment to your loved ones—a promise that, no matter what happens, they will be financially secure. At NiveshSetu, we help you make that promise real with personalized life insurance solutions that ensure your family’s future is protected.

Our goal is simple: to give you peace of mind knowing that your family’s financial needs will be taken care of, even when you’re not there. With the right life insurance policy, you can secure their dreams, safeguard their well-being, and ensure they can maintain the lifestyle you’ve worked so hard to provide.

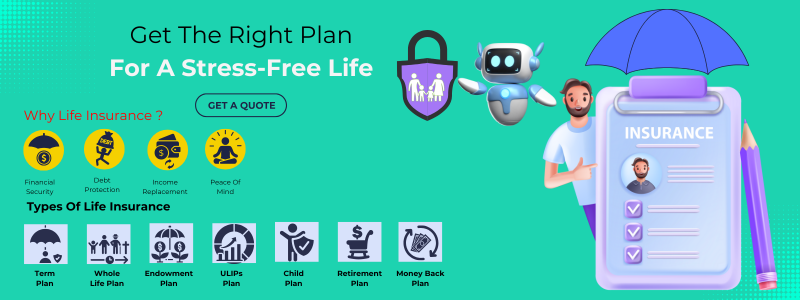

Why You Need Life Insurance?

Life insurance isn’t just about preparing for the worst—it’s about ensuring the best for your family. Here’s why life insurance is essential:

- Financial Security for Your Family: Your life insurance policy ensures that your loved ones are financially supported, no matter what happens.

- Debt Protection: In the event of your untimely demise, your family won’t be burdened with liabilities like home loans, personal loans, or education loans.

- Income Replacement: Life insurance helps replace lost income, ensuring that your family can continue to meet their day-to-day expenses.

- Peace of Mind: Life is uncertain, but your family’s future doesn’t have to be. Life insurance allows you to focus on living in the moment, knowing that the future is taken care of.

At NiveshSetu, we tailor life insurance solutions that are as unique as your life. We offer comprehensive plans that cover your specific needs and priorities, ensuring your family’s future is protected without compromise.

Our Approach: Personal, Transparent, and Caring

At NiveshSetu, we believe life insurance is a deeply personal decision. It’s not just about choosing a policy—it’s about ensuring your loved ones are protected when they need it most. That’s why we follow a customer-first approach, working closely with you to find the right plan that offers the protection your family deserves.

- Understanding Your Life’s Priorities

Every family is different, and so are their needs. We begin by listening to your unique concerns—whether it’s securing your children’s education, ensuring your spouse’s financial independence, or paying off a mortgage. Our in-depth consultation helps us design a policy that fits your life perfectly. - Determining the Right Coverage

How much life insurance do you need? That depends on various factors, including your income, financial responsibilities, and future goals. We help you calculate the right amount of coverage to protect your loved ones from financial hardship. Our goal is to ensure that your family can maintain their lifestyle and future goals even in your absence. - Tailored Life Insurance Solutions

Whether you need a term plan for cost-effective, high-coverage protection or a whole life insurance policy that builds cash value over time, we help you select the right product. We take pride in offering honest, transparent advice, ensuring that you understand every aspect of your policy—no hidden terms, no surprises. - Ongoing Policy Support

As your life evolves, your life insurance needs may change too. From getting married to welcoming a new child, or buying a home, we’re here to review and update your coverage so that it grows with your family’s changing needs.

Types of Life Insurance We Offer

At NiveshSetu, we provide a range of life insurance solutions designed to meet various needs. Here’s a quick overview of the types of life insurance we can help you with:

- Term Life Insurance:

This is the simplest and most affordable form of life insurance. It offers high coverage at low premiums, protecting your family financially if you pass away during the term of the policy. It’s ideal if you’re looking for maximum coverage at minimal cost. - Whole Life Insurance:

Whole life insurance provides lifelong coverage and also builds cash value over time, which can be used during your lifetime. It’s a perfect solution if you’re looking for both protection and savings in one policy. - Endowment Plans:

These plans offer the dual benefit of insurance coverage and savings. If you survive the policy term, you get a lump sum payout that can be used for future goals like children’s education or retirement. - ULIPs (Unit Linked Insurance Plans):

For those seeking to combine protection with wealth creation, ULIPs offer life insurance along with an investment component, helping you grow your wealth while keeping your family secure. - Child Insurance Plans:

Protect your child’s future by securing their education, marriage, and other life goals. These policies ensure that, come what may, your child’s future is financially secure. - Pension Plans:

Secure your golden years by investing in a retirement plan that provides regular income post-retirement while offering guaranteed security of your retirement corpus. These plans help you maintain financial independence during retirement while leaving a legacy for your loved ones.The rates of returns are fixed, disclosed and guaranteed right at the onset of policy protecting you from common trend of depreciating returns on investment in financial market.

What Are Riders in a Life Insurance Policy?

Riders are additional benefits that can be attached to a basic life insurance policy to provide enhanced coverage tailored to your specific needs. These optional features allow you to customize your policy, ensuring it aligns with your unique financial situation and life stage. Whether you’re looking for extra protection against critical illness, disability, or accidental death, riders offer flexibility and peace of mind by addressing potential uncertainties. By adding the right riders, you can maximize the effectiveness of your life insurance, ensuring that you and your family are well-protected against unforeseen circumstances.

Some common life insurance riders include:

- Accidental Death Benefit Rider: Provides an additional payout if the cause of death of insured is due to an accident.

- Critical Illness Rider: Offers a lump sum payout if the insured is diagnosed with a critical illness like cancer or heart disease.

- Disability Income Rider: Provides a regular income if the insured becomes disabled and is unable to earn.

- Term Rider: Allows you to add additional term life insurance coverage to your base policy for a specified period.

- Premium Waiver Benefit Rider: Ensures that the child policy coverage and benefit continues without paying any further premium in case of the death of parent.

By selecting the right combination of riders, you can ensure comprehensive coverage for both yourself and your loved ones.

Why Choose NiveshSetu for Life Insurance?

When it comes to something as crucial as life insurance, you need a partner you can trust. At NiveshSetu, we are committed to providing you with personalized, transparent, and reliable life insurance services. Here’s what sets us apart:

- Personalized Plans: We don’t just offer policies; we offer plans that are custom-tailored to meet your family’s specific needs.

- 100% Transparency: You’ll always know what you’re paying for, with no hidden fees or complicated terms.

- Expert Guidance: With over 5 years of experience and a legacy of trust from 250+ clients, we are experts at guiding you through the complex world of life insurance.

- Free Home Visits: We offer free consultations at your home for your convenience, so you can plan your family’s future in comfort.

- Lifetime Support: We are with you not just during the policy purchase, but for the lifetime of your coverage. Whether you need to update your policy or file a claim, we are always here to assist you.

Our Claim Assistance: Your Support When It Matters Most

Life insurance isn’t just about the policy; it’s about the support you receive when your family needs it most. At NiveshSetu, we understand that making a claim can be a stressful experience. That’s why we offer end-to-end claim assistance, ensuring the process is as smooth and stress-free as possible.

- Dedicated Claim Support: Our team will guide you through the claims process, helping you gather documents and liaise with the insurance provider.

- Fast and Hassle-Free Claims: We work closely with insurers to ensure your claims are settled quickly, providing your family with the financial support they need during difficult times.

Faq’s

Q1: How much life insurance do I need?

A good rule of thumb is to have coverage that’s 10–12 times your annual income, but it depends on factors like your financial obligations, debts, and future goals. We’ll help you calculate the right amount based on your situation.

Q2: What’s the difference between term and whole life insurance?

Term life insurance offers coverage for a specific period at affordable rates, while whole life insurance provides lifelong coverage with a savings component. We can help you choose the right option based on your needs.